If you're chasing financial freedom, passive income apps might be one of the easiest ways to start. These tools run in the background, working for you while you’re living your life—whether that’s grinding at your main job, hitting the gym, or catching up on sleep.

No cubicles. No clocking in. Just smart systems doing the heavy lifting. The appeal is obvious: set it up once, and let it roll. But here’s the deal—there are a ton of apps out there claiming they’ll make you money on autopilot. Some deliver. Most don’t.

In this guide, I’m breaking down the top passive income apps that are actually worth your time. We’ll look at what they are, how they work, and how to pick the ones that won’t waste your effort.

I’ll also cover how to stack apps for smarter earnings, how much time (and setup) they really require, and what kind of returns to expect.

If you're ready to ditch guesswork and start building real passive income streams, you're in the right place.

Passive Income

Passive income refers to earnings derived from sources that do not require constant, active involvement. Unlike traditional employment, passive income flows with less direct oversight.

These income streams include earnings from rental properties, dividends, and royalties. In the digital age, apps have become conduits for generating such income.

Passive income can significantly boost financial security. It allows individuals to create a buffer for themselves. As such, it is vital in achieving long-term financial goals.

Passive Income Apps That Make Money On Autopilot

If you’re serious about building real passive income streams, not every app is going to cut it. You need platforms that actually generate income in the background, with little to no daily work.

After years of trial, error, and experimentation, these are the apps worth using to start building passive income in 2025 and beyond.

1. Coinbase

Coinbase makes it incredibly easy to earn passive income by staking certain cryptocurrencies directly through their secure platform.

Once you hold eligible crypto like Ethereum, Solana, or Tezos, you can activate staking rewards that generate automatic earnings without lifting a finger.

Instead of letting your assets sit dormant, staking puts them to work around the clock. Coinbase handles the technical side, so you don’t have to deal with complicated wallets or setting up your own nodes.

Plus, the platform’s reputation for security and transparency gives you peace of mind that your funds are protected.

For anyone new to crypto or looking to diversify their passive income streams, Coinbase offers one of the most user-friendly entry points in the industry.

Whether you're earning a few dollars a month or compounding serious gains, staking through Coinbase is a true “set it and forget it” income strategy.

2. Acorns

Acorns takes the act of investing and makes it virtually invisible—and that’s exactly why it works so well for passive income.

Every time you swipe your card for a coffee, groceries, or gas, Acorns rounds up the spare change and funnels it straight into a diversified investment portfolio.

You don’t have to pick stocks, rebalance portfolios, or monitor the market; Acorns handles it all automatically. Over time, these tiny, painless micro-investments add up to real wealth.

What’s even better is that you can set recurring contributions to turbocharge your savings even more. If you’re someone who struggles with remembering to save or invest consistently, Acorns forces the habit without you even realizing it.

It’s the classic “you won’t miss it, but you’ll love it later” kind of platform—and a perfect way to build a passive income foundation in the background of your busy life.

3. Stash

Stash bridges the gap between totally passive investing and having the freedom to choose how your money grows.

With features like automated investing, stock back rewards, and personalized portfolios, Stash makes it incredibly easy to build a passive stream of income from stocks, ETFs, and bonds.

You can set up scheduled auto-investments, meaning money from your checking account flows into your investments every week or month without you lifting a finger.

Stash also offers fractional shares, so even if you only have a few bucks to start, you can own pieces of major companies like Amazon or Tesla. Over time, with compound interest and market growth, your hands-off investments could snowball into significant assets.

For anyone who wants to build wealth slowly, securely, and passively, Stash offers a killer combination of automation, control, and growth.

4. Honeygain

Honeygain is one of the purest examples of passive income you’ll find today. After a simple install on your computer or smartphone, Honeygain shares a tiny, encrypted portion of your unused internet bandwidth with their trusted network.

In return, you get paid every day, all while you go about your normal activities without interruption. The app is lightweight, secure, and doesn’t interfere with your browsing or streaming speeds.

Once you set it up, it quietly works in the background, requiring zero maintenance or engagement from you. Payments accumulate automatically, and you can cash out via PayPal or Bitcoin whenever you hit the minimum payout threshold.

If you're looking for a truly passive setup—something that earns while you literally do nothing—Honeygain is an unbeatable addition to your passive income arsenal.

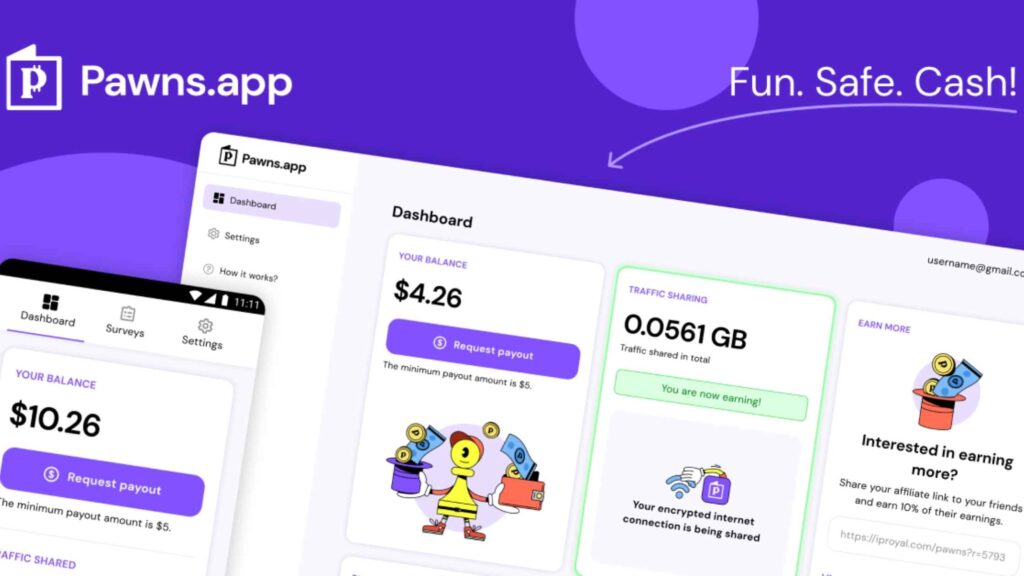

5. Pawns.app

Pawns.app works alongside Honeygain, giving you another effortless way to generate passive income by sharing your unused internet connection. Once installed, the app quietly uses a fraction of your bandwidth for legitimate research and business purposes.

What’s great about Pawns.app is the steady daily earnings you can rack up without needing to interact with the app at all. It’s incredibly beginner-friendly, secure, and optimized for low impact on your device performance.

When you pair Pawns.app with Honeygain, you effectively double your potential passive earnings without doubling your effort. Payouts are flexible, letting you cash out through PayPal or crypto, depending on your preference.

If you're already paying for high-speed internet, why not put it to work and get paid for a resource you're not fully using?

6. Sweatcoin

Sweatcoin is one of the most genius passive apps because it turns something you already do—walking—into earnings without any change to your routine.

Once you download the app and start moving, Sweatcoin counts your steps and rewards you with its digital currency. Those Sweatcoins can be exchanged for goods, services, gift cards, or even PayPal cash offers through special promotions.

Unlike fitness apps that require you to hustle harder, Sweatcoin pays you for doing the bare minimum: existing and taking steps in your daily life.

Whether you're pacing on work calls, chasing your kids around, or just strolling through the grocery store, Sweatcoin turns that effort into valuable rewards without you having to lift a finger beyond what you're already doing.

It's passive earning at its laziest—and that's exactly why it works.

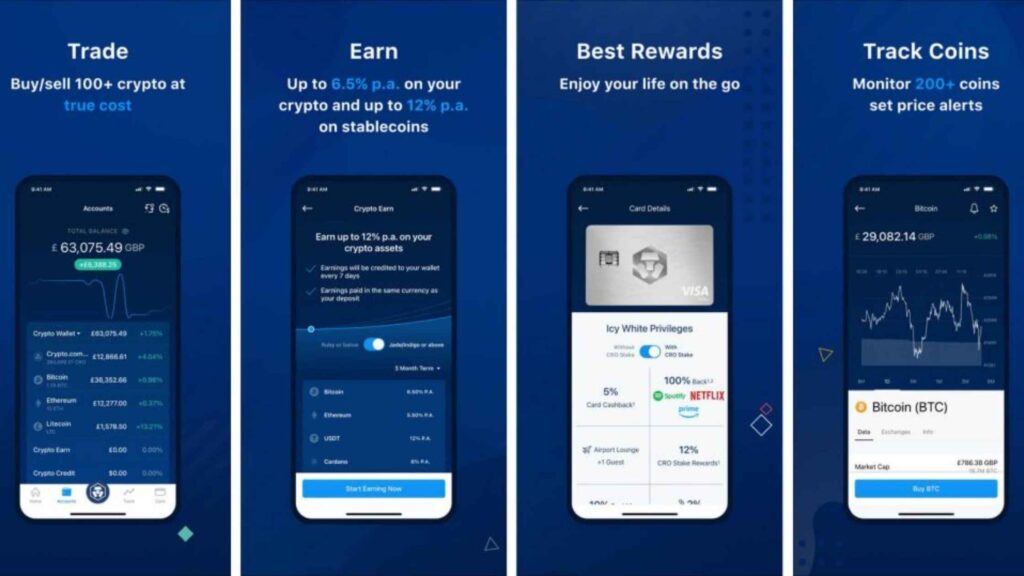

7. Crypto.com

Crypto.com offers one of the best staking platforms for turning crypto holdings into steady passive income. Their Earn program allows you to lock up cryptocurrencies like Bitcoin, Ethereum, or their native CRO token in exchange for significant interest payouts.

With flexible or fixed-term options, you can choose how aggressive or conservative you want to be. Best of all, Crypto.com’s app makes it incredibly simple to manage your portfolio, track your earnings, and reinvest your rewards automatically.

If you’re already holding crypto or looking to diversify into digital assets, staking through Crypto.com can transform idle coins into a consistent, compounding income stream. Just set it, stake it, and watch your balance grow with virtually no extra effort.

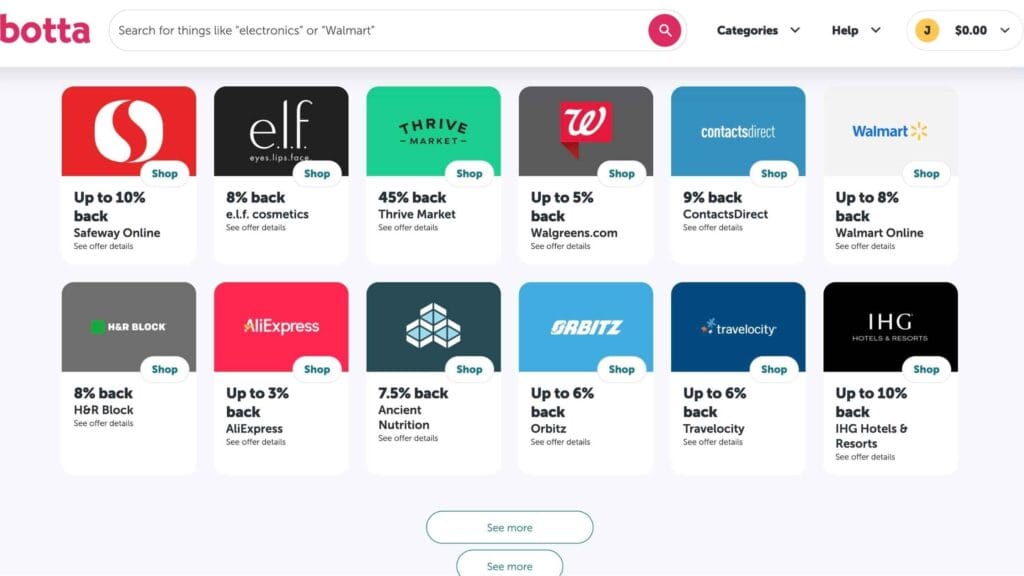

8. Ibotta

While Ibotta is more famous for cash-back deals on groceries and everyday essentials, it deserves a spot on any passive income list because of how seamless it can become.

Once you link your loyalty cards or set up browser extensions, Ibotta automatically tracks eligible purchases without requiring you to scan receipts every time. Over weeks and months, your shopping habits translate into real, tangible cashback rewards.

It's the definition of passive saving—and when you combine it with smart spending, it adds up to serious side income. The more consistent your shopping habits, the more you passively rack up savings and bonuses.

Ibotta might not make you rich overnight, but it’s a smart way to monetize your existing lifestyle without even thinking about it.

9. Fundrise

Fundrise is one of the most popular ways for everyday investors to tap into real estate and build passive income without owning physical property.

Through their easy-to-use app, you can invest in private real estate projects across the U.S. and earn returns through quarterly dividends and property appreciation.

Fundrise manages all the hard parts—buying, renovating, and maintaining properties—while you sit back and collect passive income.

The minimum to get started is surprisingly low, and you can set up automatic investments to grow your real estate portfolio over time without lifting a finger. Fundrise offers one of the easiest paths to hands-off real estate investing without becoming a landlord.

10. Arrived Homes

Arrived Homes is another real estate investing app that focuses on true passive income by letting you buy fractional shares of rental properties.

You own a piece of real income-generating homes and receive quarterly payouts from the rental income without worrying about tenants, repairs, or property management headaches.

The app breaks down all the property details, expected returns, and locations so you can make informed decisions without becoming a real estate expert.

With low minimums and an intuitive setup, Arrived Homes makes it possible to generate truly passive real estate income on autopilot—whether you invest $100 or $10,000.

11. Token Metrics

Token Metrics isn’t a passive income app in the traditional sense—but it’s a powerful tool for growing passive crypto wealth smarter. It uses artificial intelligence to analyze crypto projects and recommend high-potential coins.

Instead of gambling or chasing hype, Token Metrics gives you data-driven insights to make smarter investment decisions that can lead to compounding returns over time.

For investors serious about using crypto for passive income through staking, yield farming, or strategic buying, Token Metrics adds a professional layer of intelligence you can rely on.

Best of all, it’s an app you set up once to automatically receive portfolio suggestions and investment reports, cutting out hours of manual research.

The Rise of Passive Income Apps

With technological advancements, passive income has taken on a new form. Apps now offer avenues to generate income effortlessly. This development has opened new opportunities for financial independence.

Digital platforms are embracing the “set it and forget it” model. Automation and AI algorithms are critical to this success. They facilitate seamless income generation, making these apps highly attractive.

This trend is also driven by a shift in work culture. Many seek financial freedom beyond traditional employment. Passive income apps effectively offer this liberation, making them increasingly popular.

Suggested reading: Apps That Give You Money- Highest Paying Apps of 2025

The world of passive income apps is exciting, but success doesn’t come by accident. It comes from focus, smart decision-making, and consistency. If you’re serious about building real passive income, it’s time to take action with the right mindset.

Action Steps for Getting Started with Passive Income Apps

Before you dive into downloads and sign-ups, you need a simple game plan. Start by defining a realistic financial goal. Whether it’s $100 extra a month or saving for a vacation, knowing what you’re aiming for will keep you motivated.

Next, select two or three passive income apps that align with your goal. Don't overwhelm yourself by trying too many at once. Master a few first.

Use apps that offer real earning potential—like Acorns for micro-investing, Sweatcoin for fitness-driven rewards, or Ibotta for everyday cash back.

Finally, commit to consistency. Passive income is built over time, not overnight. Whether it's checking in weekly, reinvesting your earnings, or sharing your referral links with friends, small steps compound into big results.

Realistic Expectations: Passive Income Is Slow but Steady

One of the biggest mistakes beginners make is expecting overnight results. Passive income apps work best when you give them time. Your returns may start small—just a few dollars here and there—but momentum builds the longer you stay consistent.

The key is to think of passive income apps like planting seeds. At first, you don’t see much. But keep watering those seeds, and eventually, you’ll have a thriving garden of income streams supporting your financial goals.

Suggested reading: Saving Money on a Budget: Build Smarter Habits That Stick

Long-Term Wealth Strategy Using Passive Income Apps

Passive income apps are not get-rich-quick schemes. They’re tools for building lasting wealth by stacking small wins over time. Used wisely, they supplement your active income and provide stability during uncertain times.

Combine the power of these apps with smart money habits like budgeting, investing, and saving. This blend creates a diversified financial future where you’re not dependent on a single paycheck or one unpredictable source of cash.

Smart users integrate passive income apps with traditional strategies like high-yield savings accounts, index fund investing, and small business ventures to create a well-rounded financial game plan.

Suggested reading: Financial Planning Tips for New Entrepreneurs

Passive income Apps: Start Small, Stay Consistent, And Win Big

Passive income apps are an incredible gateway into building wealth with minimal effort after initial setup. But like any worthwhile endeavor, results require patience, strategy, and discipline.

By choosing the right apps, setting realistic goals, managing your earnings smartly, and staying consistent, you can build a powerful network of income streams that work for you day and night.

No matter where you start, remember: small steps today can create massive opportunities tomorrow. If you're ready to set it and forget it—and then watch your savings grow—the world of passive income apps is wide open for you.

Start now. Stay consistent. And let your money work for you while you live your life.