One of the most underrated budgeting tips is also the most basic, which is to start with a plan that fits your life, not someone else’s. Too many people try to copy cookie-cutter templates they find online, but your budget should reflect how you live, spend, and earn.

Budgeting isn’t about punishment or sacrifice. It’s about building freedom and taking back control of your income.

Build a Budget That Actually Works for Your Lifestyle

A good place to begin is by categorizing your spending into essentials (housing, food, utilities), financial goals (savings, debt payments), and fun (yes, that latte counts).

When you assign a purpose to every dollar, you start noticing where your money leaks away. From there, you can adjust without feeling deprived. Budgeting tips that promote sustainability always win over restrictive ones that cause burnout.

Don’t forget to review and adjust your budget monthly. Life changes, and so should your plan.

Don’t Just Track Your Spending—Automate It

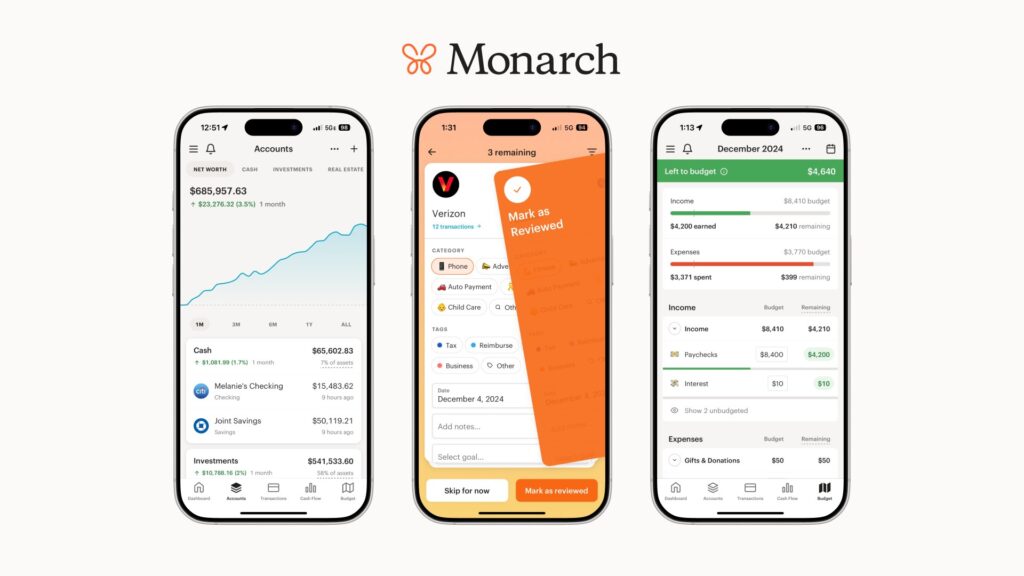

Let’s talk tech. Because while spreadsheets are great, they can’t compete with tools like Monarch Money that are designed entirely for budgeting and money management.

One of the smartest budgeting tips is to automate your finances as much as possible, and Monarch makes that easy with clean dashboards, personalized insights, and syncing across all your accounts.

With Monarch Money, you’re not just logging expenses—you’re building a financial ecosystem. It pulls in your income, investments, debts, and bills to give you a full picture of your financial health.

It lets you create custom budgets that evolve with your lifestyle. Whether you’re a side hustler, freelancer, or 9-to-5er with benefits, Monarch adjusts to you. Automation reduces stress and cuts down on mistakes.

It also keeps you consistent, which is the real secret sauce to making a budget work long-term. I honestly do not know how I managed my finances before I began to use Monarch Money.

Monthly Pocket Drainers: Subscriptions You Forgot You Had

If there’s one area where money disappears like magic, it’s monthly subscriptions. And one of the most powerful budgeting tips you can follow is to do a subscription audit every 90 days. Streaming services, apps, software, meal kits all add up fast.

What starts as a $7.99 “free trial” becomes a year-long drain on your budget. Canceling unused subscriptions is instant gratification for your finances. You don’t have to give up everything, just the ones you don’t use.

And even for the ones you love, look for bundled plans or yearly billing options to reduce costs. Apps like Monarch Money can even flag recurring payments for you, making it easier to spot and eliminate waste. It’s like giving yourself a raise without changing jobs.

Insurance: The Sneaky Money Pit You’re Probably Overpaying For

Let’s be honest, insurance is one of the most boring line items in your budget. But it’s also one of the most bloated. One of the most practical budgeting tips that goes overlooked is reviewing your insurance plans once a year.

Recent studies have shown us that nearly 60% of Ameican's are overpaying for insurance when the same coverage exists for cheaper. Home, renters, pet, life, auto, and other premiums creep up, and you barely notice because they’re autopay.

Here’s where Lemonade insurance comes in. Unlike traditional insurers, Lemonade uses AI to offer faster, cheaper coverage for renters, homeowners, and even pet parents. The application process takes minutes, and claims are often settled in seconds.

Switching to Lemonade can shave hundreds off your annual expenses, especially if you’re currently with a legacy provider. Plus, Lemonade is a B-Corp, which means they give back unclaimed money to charities. So you save and support good causes.

I literally saved hundreds of dollars each year after I switched to Lemonade. I even remember at a point when I had to pay for renters' insurance, which only cost me $30 for an entire year! I kid you not.

If you want to know how Lemonade Insurance compares to others, I created this helpful review – Lemonade Insurance: How It Compares To Other Insurances.

Cook More Meals at Home

I know you heard this one before. You're going to hear it again! I know how much (including myself) love a meal that's ready fast, tastes amazing, and enjoys trying new things in exchange for a hefty price. But what price is worth it to you?

You don’t need to be a gourmet chef to eat better and spend less. One of the smartest and most actionable budgeting tips is to increase how often you cook at home.

Even if that just means four nights a week, you could save over $2,000 annually compared to dining out or ordering takeout. Keep it simple and use meal planners, batch cook, and lean into crockpot or sheet pan recipes that take minimal effort.

Also, when you cook at home, you avoid unnecessary taxes and tips that add up fast on top of an already expensive meal. I mean there must be a reason this is constantly a budgeting suggestion, right?!

Slash Utility Bills by Upgrading Your Everyday Habits

You don't have to install solar panels or buy a Tesla to reduce your utility bills (although I do always like to recommend it).

The most effective budgeting tips often come down to small tweaks: unplug unused electronics, switch to LED bulbs, wash clothes in cold water, and use smart thermostats like Nest to regulate heating and cooling.

Even simple habits like turning off lights when you leave a room or running your dishwasher at night can add up. And if you want to take it one step further, call your providers and negotiate lower rates, especially for internet or bundled services.

Many companies have unadvertised loyalty discounts, but you have to ask. This is one of those areas where effort equals reward, and your budget will thank you every month.

If budgeting has become an issue because of family size, try reading Living on a Budget as a Family: 30 Practical Tips to Live Cheaply.

Cut Credit Card Interest with a Strategic Balance Transfer

Credit card debt is brutal, and if you’re carrying a balance, interest charges can sabotage your entire budget. One of the most effective budgeting tips for tackling debt is to do a balance transfer to a 0% APR credit card.

Many cards offer a 12- to 18-month interest-free window, giving you time to pay down your balance without it snowballing. Just make sure you pay it off before the intro period ends, and avoid using the card for new purchases while you’re in payoff mode.

Apps like Monarch Money can help you track your payoff plan and keep you accountable. Paying less interest is like finding money in your budget you didn’t even know you had.

Give Every Dollar a Job—Yes, Even Your Fun Money

When you budget, it’s easy to focus only on rent, bills, and debt. But fun money matters too. One of the most underrated budgeting tips is to intentionally plan for joy. Allocate a realistic amount for dining out, hobbies, or spontaneous splurges, and stick to it.

This concept especially stands out to me because I find that budgeting is usually quite boring to most people. However, doing things like creating a monthly budget of money you can actually spend helps make budgeting more joyful and enjoyable.

If you don’t, you’re more likely to blow your budget during a rough week or after payday. By giving your fun money structure, you create guilt-free freedom and eliminate impulse spending.

Monarch Money even let you label spending categories by mood or purpose, making budgeting feel more personalized and less rigid.

Most commonly asked questions based on budgeting tips

How can I start budgeting if I live By Paycheck?

Start small. List your non-negotiable expenses first (rent, food, transport) and work from there. Track every dollar for a month, then find where cuts can be made.

Sometimes the key to budgeting that you have been missing is building the right habits that stick. In that case, you can check out Saving Money On A Budget: Build Smarter Habits That Stick.

Is Lemonade insurance legit and actually cheaper?

Yes. Lemonade insurance is fully licensed, well-rated, and often significantly cheaper because it uses technology to streamline operations. Many users save hundreds annually after switching, especially for renters and homeowners.

What’s the best free app for budgeting beginners?

While there are several, Monarch Money stands out for its user-friendly interface and advanced features—even in its free tier. It’s a great way to build good habits and get a bird’s-eye view of your finances.

How often should I update or adjust my budget?

Ideally, review your budget monthly or whenever your income or expenses change. The goal is to keep it current and responsive, not static.

If you are reading this blog post to help save money so you can move out and get your own place, you might be wondering How Much Money Do You Need to Move Out Today? which I talk all about in this article.

Budgeting Leads To Better Financial Management

The journey to financial confidence doesn’t require a massive sacrifice; it just requires consistency, awareness, and the right tools.

By using these proven budgeting tips, you’re setting yourself up for smarter decisions, fewer money regrets, and way more wins over time.

Whether it’s cutting your insurance bill by switching to Lemonade, tracking every cent with Monarch Money, or simply cooking more meals at home, every positive habit adds momentum. The key is to start where you are.

You don’t need to be perfect. You just need to be in motion. Remember, budgeting isn’t about restricting your life, it’s about unlocking your freedom. The more you practice it, the more empowered you become.

You’ll stress less, save more, and feel confident that your money is working for you, not the other way around. Also, if you want to learn more about the business side of budgeting, I suggest my blog post about How to Create a budget for your business.

Take Charge: Your Budgeting Starts Today

Set up your budget. Cancel what you don’t use. Shop smarter. Use tech to make it easier. Switch to Lemonade insurance and explore Monarch Money to take control of every dollar.

And if this post fired you up, stick around! I cover everything from wealth-building strategies to financial independence game plans right here on The Limitless Drive. The road to financial freedom is smoother and way more fun when you have the right guide riding shotgun.