Have you been looking for the perfect budgeting apps built for couples? I get it, finances can be a tough thing to manage alone, let alone with your spouse, or rather, especially with your spouse. Sometimes it feels impossible to get on the same page.

Whether you’re just moving in together, planning a future, or already married with shared expenses, the right app can help you both feel confident, organized, and heard.

In this guide, we’re breaking down the best budgeting tools for couples in 2025, how they stack up, and how to choose one that actually fits your lifestyle (and your personalities).

My Top Favorite Apps For Couples

Whether you’re starting small or ready to overhaul your entire financial game plan, these are the best budgeting apps for couples in 2025 that can actually make a difference.

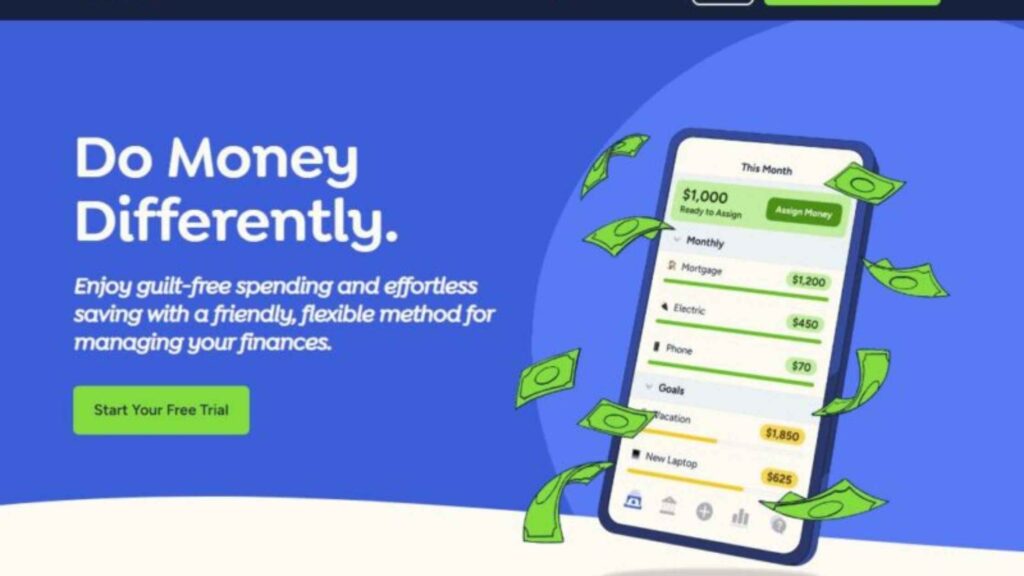

1. You Need a Budget (That's Actually What It's Called)

If you’re ready to get serious about budgeting, YNAB is one of the most powerful tools on the market for couples.

It’s based on the zero-based budgeting method, which means every dollar you earn is given a job whether that’s going toward bills, savings, or discretionary spending.

This approach helps couples avoid overspending and truly plan ahead. What makes YNAB stand out for couples is the real-time syncing, custom goal tracking, and robust forecasting tools.

You can set up shared categories for household expenses, savings goals, or debt payoff, while still maintaining some personal financial independence within the app.

The learning curve is a bit steeper than others, but the payoff is worth it if you’re looking to transform your financial habits together.

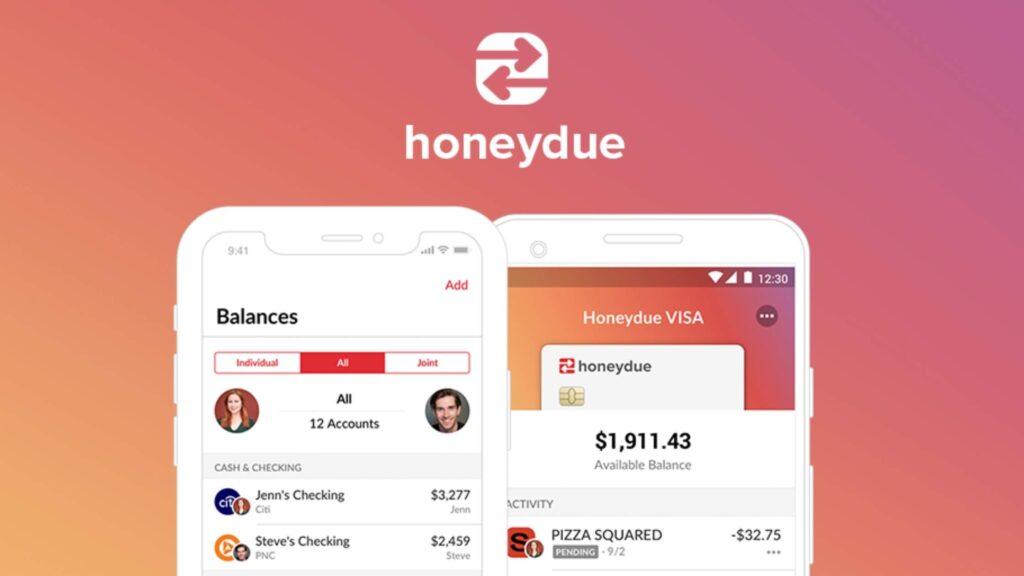

2. Honeydue

Honeydue is one of the most popular and accessible budgeting apps made specifically for couples. It’s simple, free, and gives each partner the power to choose which accounts or transactions to share.

You can both stay in sync with bill tracking, spending alerts, and monthly budget limits. The app is great for newer couples or those just starting to combine finances.

The user interface is friendly and modern, and you can even send each other emojis and notes about transactions (yes, really). For my wife and I, we always appreciate little fun things like that. It helps make finances more fun and less stressful.

While it doesn’t have advanced forecasting tools, Honeydue shines in helping couples stay transparent and organized without overwhelming them completely.

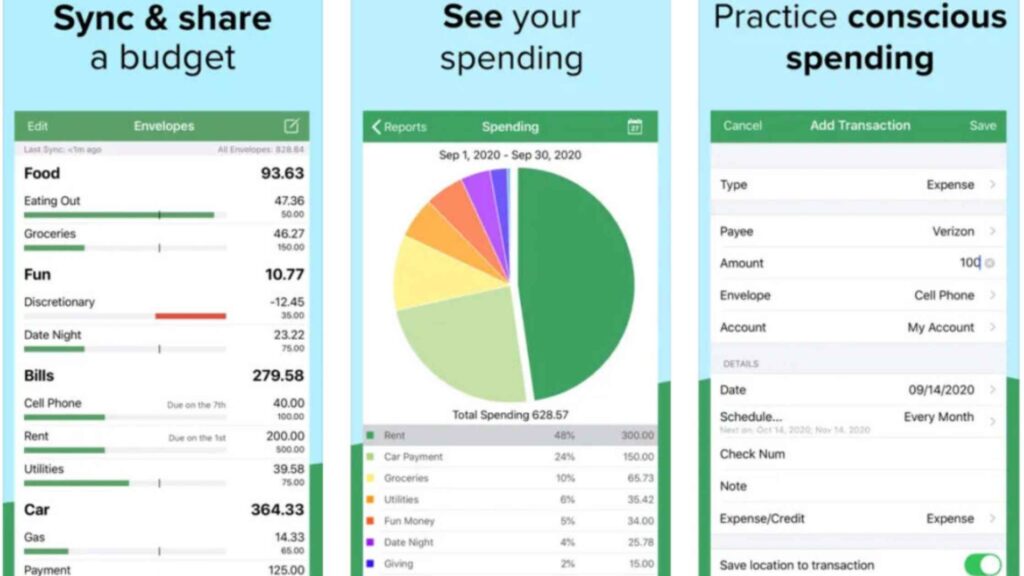

3. Goodbudget

If you love the old-school envelope budgeting method, Goodbudget gives you a modern, digital way to use it as a couple. I also like the simplified charts that provide an easy way to see whats going on each month.

Instead of carrying around physical envelopes, you and your partner divide income into digital envelopes that are categorized by spending type—like groceries, rent, entertainment, or date nights.

You can share envelopes across both devices, plan joint expenses, and review where every dollar is going. While Goodbudget doesn’t link to your bank accounts, some couples actually prefer that—it forces you to be more intentional.

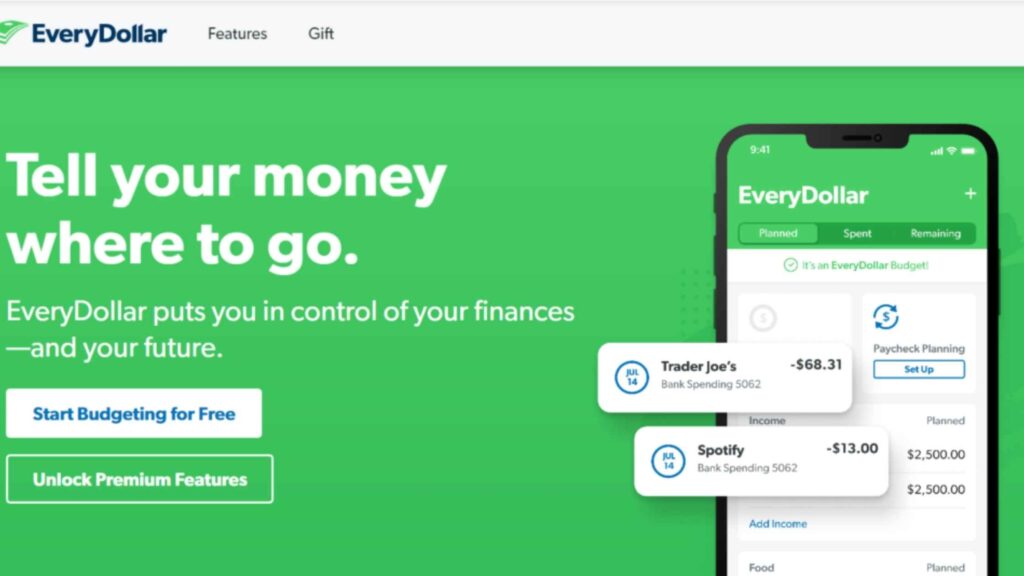

4. EveryDollar

Created by Dave Ramsey’s team, EveryDollar is built on the zero-based budgeting method and helps couples assign every dollar to a purpose before they spend it.

While the free version requires manual entry, the paid version syncs to your bank accounts and updates automatically, making it much more efficient for busy couples.

It’s a great option for couples who follow (or want to follow) the Ramsey philosophy, especially if you’re focused on debt payoff and long-term savings goals.

5. Cleo

If budgeting usually feels like a chore, Cleo might just change your mind.

As one of the best budgeting apps for couples who want to engage with their money in a fun, low-pressure way, Cleo is powered by a snarky AI chatbot that gives spending feedback, personalized financial advice, and a few laughs along the way.

It’s ideal for couples who want to track money without the spreadsheet headaches. You’ll get spending breakdowns, reminders to save, and even a credit builder feature. To me, this app feels more like texting a friend than managing a budget.

It syncs with your accounts, gives real-time updates, and if you're into it, Cleo will roast you when you overspend. Another reason for you not do it! Haha

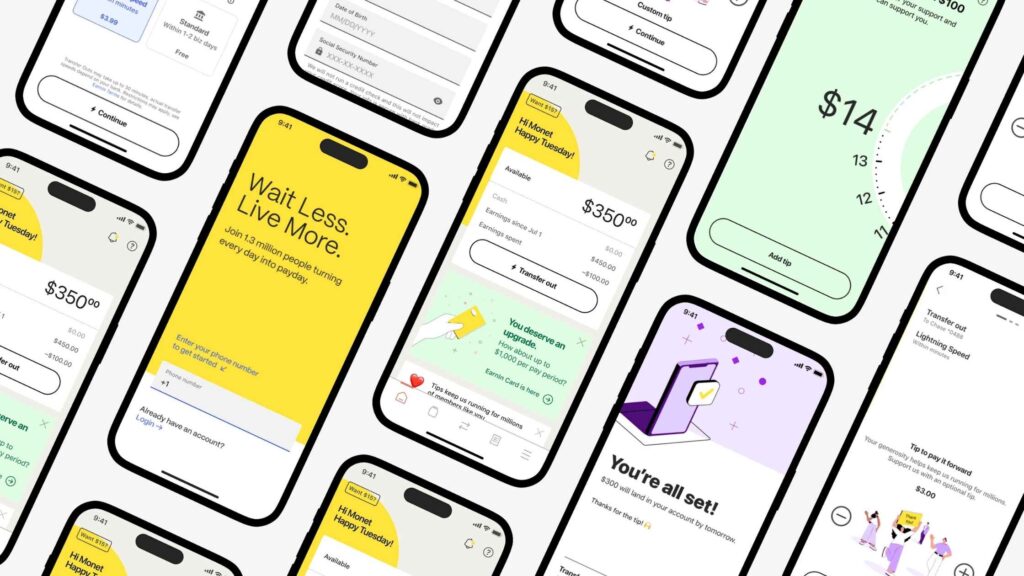

6. EarnIn

For couples who need a little more financial flexibility, EarnIn is one of the best budgeting apps for couples looking to smooth out cash flow between paychecks.

This app gives you early access to your earnings, up to $100 a day or $750 per pay period, without interest or credit checks. Just link your bank account and pay EarnIn back automatically on payday.

If you're working on a tight budget and timing bills to your income, this can help you avoid overdraft fees or missed payments. The interface is awesome and super simplistic.

If you’re looking to boost your shared savings or build a rainy-day fund faster, try finding apps that give you money by completing simple tasks, which can help you earn extra cash without changing your routine.

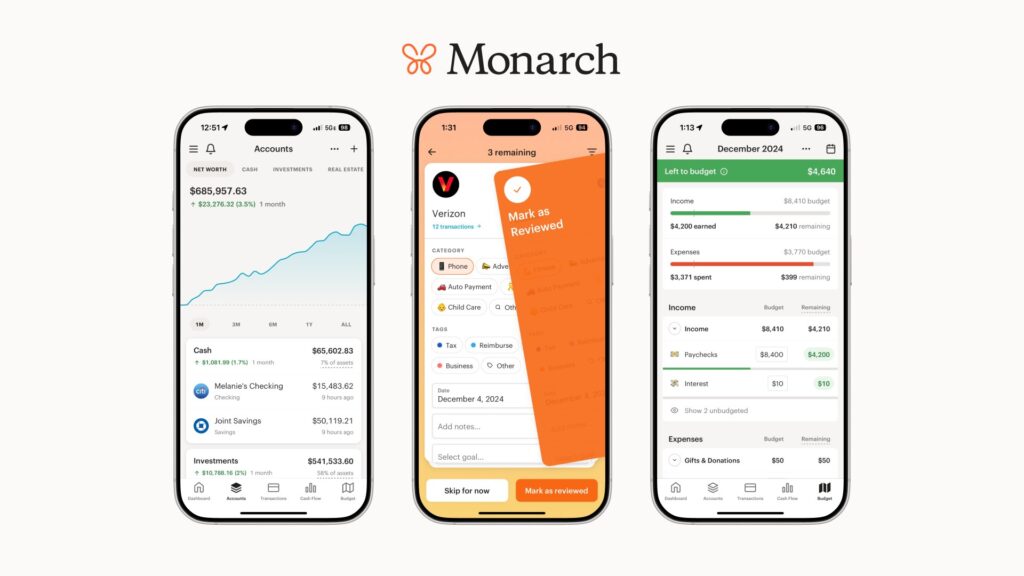

7. Monarch Money

Monarch is perfect for couples who want all their financial information in one sleek, organized space. What sets Monarch apart among the best budgeting apps for couples is its detailed overview of everything, and I MEAN EVERYTHING.

Not all apps can track spending, saving, bills, investments, and even net worth. I personally have only seen a handful that can do this and are worth it. This is one of them! Sign up for Monarch Money here to track, budget, and plan your finances together.

If you and your partner are not only sharing personal finances but also managing a side hustle or small business together, you'll want to check out how to create a budget for your business to stay organized and profitable on both fronts.

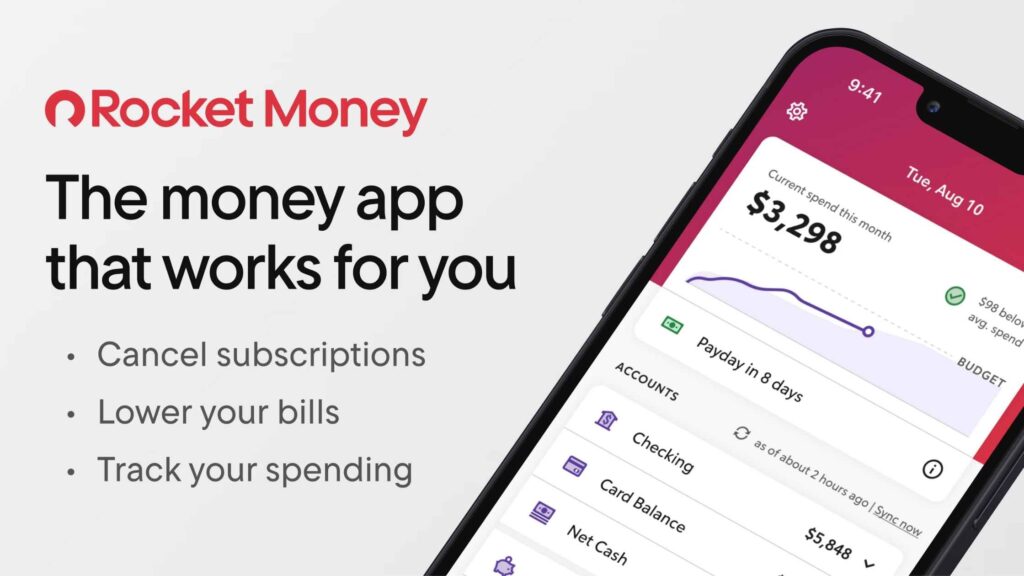

8. Rocket Money

Rocket Money (formerly Truebill) does more than track your budget. It can also actively help you lower your bills.

This app specializes in subscription tracking and negotiation, making it one of the best budgeting apps for couples who constantly say “we really need to cancel that.” You know who you are!

It scans your connected accounts, identifies recurring charges, and can cancel them with a tap. Rocket Money can also negotiate bills like internet and phone charges, and only charges a percentage of the savings if it’s successful. I mean, cmon, that's cool!

Add in net worth tracking, credit score monitoring, and smart savings tools, and you’ve got a full-featured financial assistant.

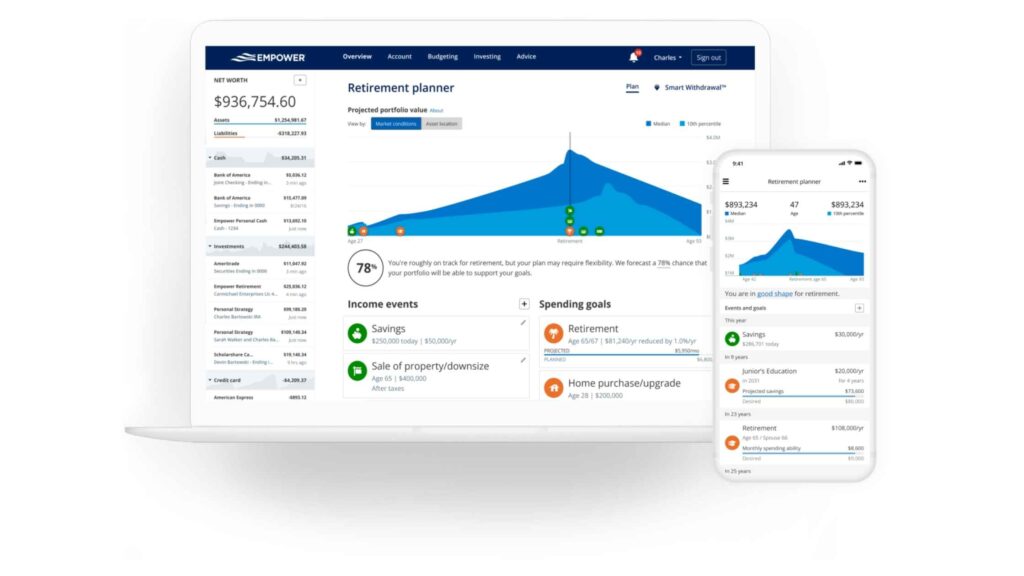

9. Empower

Empower focuses on more than just daily budgeting. It’s one of the best budgeting apps for couples who are thinking about big-picture goals like retirement, investments, and net worth tracking.

The app syncs all your financial accounts, from checking to 401(k)s, and gives you a comprehensive snapshot of your financial life. It even has a free retirement planning tool and investment checkup feature, so you can see if you're on track to hit your goals.

For couples serious about building wealth and planning the future together, Empower delivers insights and clarity that most other budgeting apps can’t match.

Once your budget’s in place, consider growing your wealth together with smart investment picks from The Motley Fool—a trusted resource for long-term financial planning.

10. Quicken Simplifi

Quicken Simplifi lives up to its name. It's one of the best budgeting apps for couples who want to ease into the world of shared finance without being overwhelmed by features like the rest of us.

The interface is clean, the setup is intuitive, and everything from bank accounts to credit cards to investments can be synced in a couple of clicks.

You’ll get visual spending plans, goal tracking, and real-time updates on your finances. For new couples or those just starting to share money management responsibilities, Simplifi offers the right balance of guidance and simplicity.

11. PocketGuard

PocketGuard is the budgeting buddy you didn’t know you needed. If you and your partner want a stress-free way to see what’s safe to spend, PocketGuard tells you exactly how much is “in your pocket” after accounting for bills, savings, and goals.

It even categorizes your spending and alerts you if you're close to blowing your budget. As one of the best budgeting apps for couples who want automation and ease, PocketGuard offers both zero-based budgeting and envelope-style systems for flexibility.

If you are a couple prone to impulse spending or forgetful tracking, this one’s a solid win in my book. I like to see everything in one place, so I know where I am really at financially, which helps avoid the impulse buys we all know you do not need.

Budgeting apps are just the start. If you're serious about long-term success, dive into saving money on a budget to master the habits that help your plan actually stick.

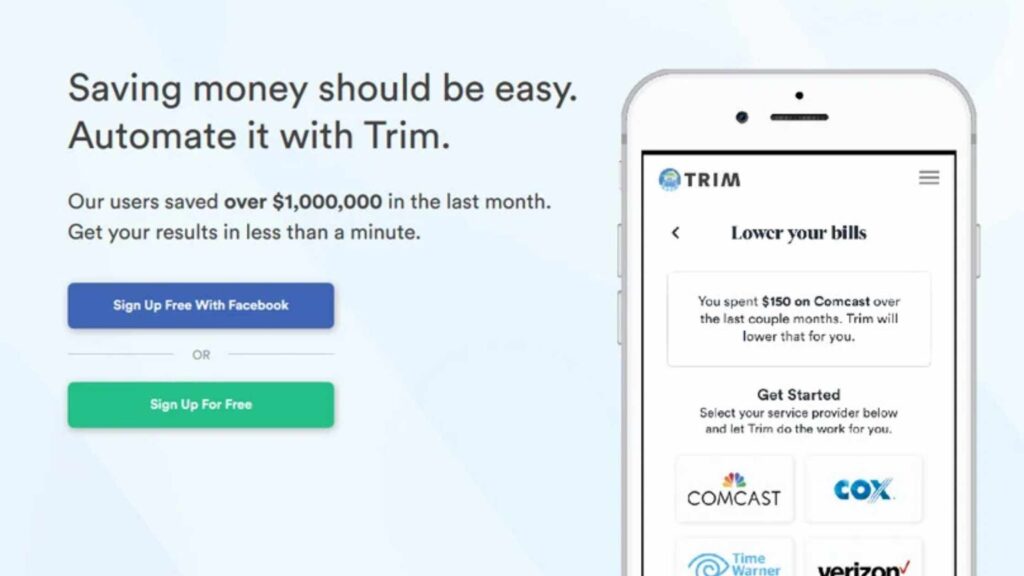

12. Trim

Trim is like a personal finance assistant that lives in your phone. It connects to your bank account and hunts down savings opportunities—canceling subscriptions, negotiating bills, and even spotting bank fees to request refunds.

If you and your partner are tired of trying to find where your money disappears every month, Trim gives you a full picture.

For couples balancing budgeting and business growth, these financial planning tips for new entrepreneurs can help you manage personal and professional goals without burning out.

My Personal Experience Using Budgeting Apps With My Partner

When my partner and I first moved in together, we didn’t have a system. Rent, groceries, date nights—it was all kind of “figure it out as we go.” And surprise, that didn’t work.

We were overspending, unaware of exact bill dates, and constantly confused about what was coming in vs. going out. We tested out a few apps and eventually landed on one that made sense for both of us.

What changed wasn’t just the numbers. It was how we communicated. Suddenly, we had a system that replaced assumptions with real data and charts, and it just felt so awesome to have all of that in check.

We could plan better, avoid awkward money talks, and even celebrate hitting goals together. It didn’t just fix our budget, it upgraded our relationship which is the most important thing to both of us.

FAQ'S For Couples About Budgeting Apps

What’s the best free budgeting app for couples?

Honeydue and Monarch Money are two of the most popular free budgeting apps built specifically for couples. Both offer joint goal tracking, real-time syncing, and easy interfaces that don’t require much setup.

They're ideal if you want to budget together without paying for a premium tool.

Should couples link bank accounts to budgeting apps?

That depends on your comfort level and financial setup. Some couples prefer to link everything for full transparency, while others like to keep some distance of complete awarness.

Can budgeting apps really improve your relationship?

Yes, absolutely. One of the top stressors in relationships is money. Budgeting apps help eliminate confusion and reduce conflict by giving both partners access to the same financial information.

When you're working from the same numbers, you're less likely to fight about money and more likely to work toward shared goals together. I can tell you from personal experience that it is a hundred percent worth it.

How do you talk to your partner about using a budgeting app?

Start by framing the conversation around shared goals. Whether it’s paying off debt, saving for a trip, or just reducing financial stress, explain that using a budgeting app isn’t about control. It’s truly about building a system that helps you both work together.

What is the best way to budget as a couple?

The best way to budget as a couple is to start with a clear conversation about your financial goals, then use a shared app that fits your style. Agree on categories, assign responsibilities, and set regular check-ins so you’re both invested in the plan.

Choosing The Right Budgeting App

The best budgeting apps for couples aren’t just about crunching numbers, they’re about building financial unity and teamwork through goals that align with you both.

Whether you’re saving for something big or just trying to keep day-to-day spending in check, these tools give you the structure to succeed without letting money rule your relationship.

Find the app that fits your rhythm, agree on your shared goals, and let the tech take care of the rest. When your finances are aligned, your future feels a whole lot lighter, and that’s worth every penny.