A good credit score isn’t just a number—it’s a financial superpower that can save you thousands of dollars over time. Better credit scores mean lower interest rates, reduced loan payments, and more financial opportunities.

If you’ve ever wondered why credit scores are so important, this guide will explain how boosting yours can help you save money in the long run.

Credit is one of those things most people do not care about and find annoying, and I can't say I blame them. But just because you do not like how credit works does not mean you should not learn about it or use it properly.

Credit debt and credit scores are real, no matter how much you and everybody else wish they weren't. So instead of ignoring them, I will be explaining why it matters, what you could be missing, and how to improve your financial state with credit.

What Is Credit Score and Why Does It Matter

Your credit score is a three-digit number that reflects how trustworthy you are as a borrower. It is based on factors like payment history, credit utilization, and credit length.

Lenders use this score to decide whether to approve loans, credit cards, or mortgages and to determine the interest rates you’ll pay. The higher your credit score, the more trustworthy you appear to lenders.

Think about it like this. If you were an employer looking to hire someone for a role that pays 100k, wouldn't you want to know if that person can bring you the results that are worth all of that money? I know I would haha.

The credit score system operates similarly. It takes time to build your credit score, just like it takes time to qualify for that position paying 100k. You have to prove that you are responsible and financially credible to lenders.

A high credit score can get you better financial deals, while a low credit score can cost you more in interest, fees, and missed opportunities. If saving money is a priority, improving your credit score should be too.

How Credit Scores Impact Your Future

One of the biggest ways your credit score impacts your finances is through interest rates. When lenders view you as a low-risk borrower, they reward you with lower interest rates. This applies to credit cards, car loans, personal loans, and mortgages.

For example, let’s say you need a $10,000 car loan. A borrower with a high credit score may qualify for a 4% interest rate, while a borrower with a low credit score may face a 10% interest rate.

Now, put into numbers, that means the difference in interest would be about $600 for this car loan, based on the difference in interest rates here. And that's just for one loan!

Over the life of a loan, the person with the lower credit score could pay thousands more in interest alone. This difference can have a huge impact on your overall financial health.

Just to let you know, I am not trying to scare you here with credit, but it is important to see why credit matters so much for your financial future.

The Benefits of a Good Credit Score

A good credit score doesn’t just save you money—it opens the door to better financial opportunities. Lenders, landlords, and even some employers view your credit as a reflection of your reliability.

When your score is high, you’ll enjoy benefits that make life easier and less expensive. Some key benefits of a high credit score include lower monthly loan payments, access to higher credit limits, better credit card perks, and easier approval for rental applications.

You’ll also avoid the stress of dealing with predatory lenders who charge sky-high interest rates for people with poor credit. And there are plenty of those out there!

How Credit Scores Impact Loans and Debt

When it comes to loans, your credit score can make or break your financial stability. Borrowers with higher scores qualify for lower interest rates, which reduces the total cost of loans. This applies to mortgages, auto loans, student loans, and personal loans.

A better credit also means more manageable debt. With lower monthly payments, you’ll have more room in your budget to pay off debt faster and afford all of life's expenses.

This can help you avoid falling into a cycle of borrowing and struggling to make ends meet. Improving your credit score is one of the most effective ways to take control of your debt.

Related reading: Business Loans: An easy to understand guide.

How to Boost Your Credit Score & Improve Your Financial Future

If your credit score isn’t where you want it to be, don’t worry. You can take specific steps to improve it over time. Here’s how to get started even if you have not yet.

1. Pay Your Bills on Time!

Your payment history accounts for 35% of your credit score, making it the most important factor. Even one missed payment can hurt your score, so staying consistent is crucial. Set up automatic payments or reminders to avoid missing due dates.

Prioritize paying off cards, loans, and utility bills on time to keep your score moving in the right direction. Some lenders will often look at this more importantly than your credit score even in the early stages of credit.

When you are first starting out with credit, you have little to no leverage. The average lenders like to see about 5 years or more of credit history. But there is hope!

You may not have much leverage, but if you are to have any within this timeframe, it will be that you have never missed a payment and have always been on time.

2. Credit Utilization

Credit utilization—the amount of credit you use compared to your total limit—makes up 30% of your score. Aim to keep your credit utilization below 30% to boost your score.

Lenders do not like to see that someone is maxing out their credit card every month. This just demonstrates that you are not financially stable enough for them to provide you with more money.

Keeping the amount you spend every month at 30% or below is the best way to build credit without showing to lenders how desperate you are for money. Because they will take advantage of that, and it can also impact your credit negatively as well!

If possible, pay off your credit card balances in full each month. If you can’t, focus on paying more than the minimum to steadily lower your balances instead of letting them accumulate to a point of no return.

Suggested reading: Can You Actually Make Money from Surveys?

3. Check Your Credit Reports Properly

Mistakes on your credit report can drag down your rating. Review your report regularly to check for errors like incorrect account balances or late payments you didn’t make.

You can access free credit reports from all three major credit bureaus at AnnualCreditReport.com. Dispute any errors you find to have them corrected.

However, be cautious that, for whatever reason, checking your credit score too frequently can also damage your credit. It is important to use a third party

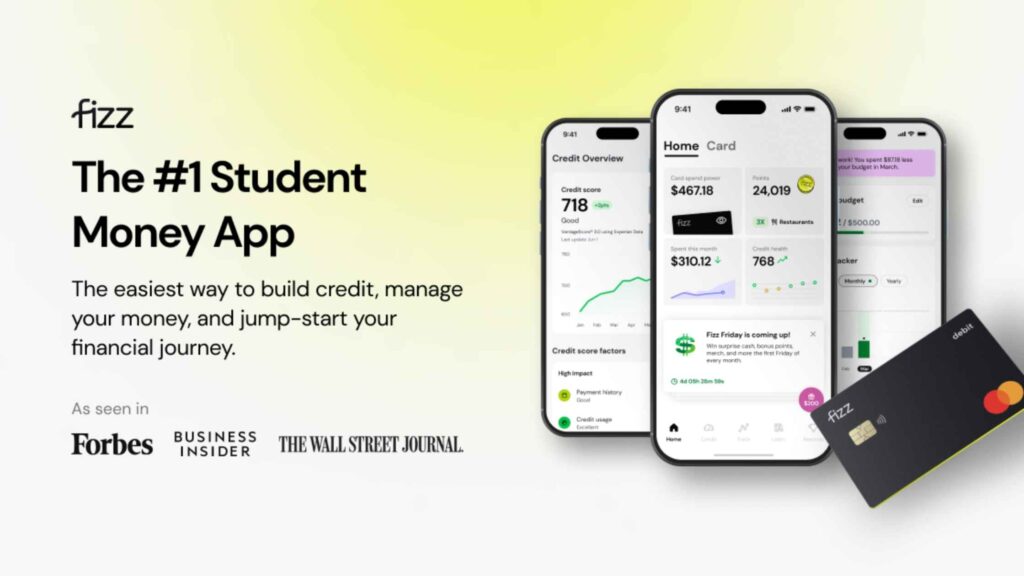

I like to use Fizz when checking my credit scores because it offers free checks and even provides useful tips and strategies to improve credit.

4. Avoid Applying for Too Much Credit

Each time you apply for new credit, a hard inquiry appears on your report. Too many hard inquiries in a short period can lower your score. Only apply for new credit when you truly need it. Space out applications to minimize the impact on your credit reports.

If you do not know what a hard inquiry is, you can think of these as loan applications. Each time you apply for a loan for a home or car, it counts as a hard inquiry.

5. Build a Long Credit History

The length of your credit history makes up 15% of your impacted ratings. The longer your accounts have been open, the better. Keep old credit cards open, even if you don’t use them often. Patience is key—time will naturally improve your credit history.

As your credit ages, your score will continue to rise further as well. Make sure you have multiple accounts for your credit score, but it does not mean you need to use all of those accounts.

Sometimes the best thing you can do with additional credit cards or credit accounts is just let them sit over time using them minimally. The more accounts you can prove you know how to manage, the more lenders will trust you.

With that being said, do not go overboard either. Having too many credit cards can actually damage your credit score. 2 or 3 strong credit reports opened around the same time will look great as you continue to boost your scores.

How Better Credit Saves You Money on Loans

Loans are often the largest financial commitment people make. Whether you’re buying a home, financing a car, or consolidating debt, your credit score significantly impacts what you’ll pay.

A better score leads to lower interest rates, which can save you tens of thousands of dollars over time.

For example, if you’re buying a $300,000 home, someone with a high credit score might qualify for a 3.5% interest rate. This translates to a $1,347 monthly payment.

In contrast, someone with a low score might face a 5% interest rate, resulting in a $1,610 monthly payment. Over 30 years, the difference adds up to over $94,000 in extra interest for the lower-score borrower.

Suggested reading: Financial Planning Tips for New Entrepreneurs

How Credit Scores Affect Credit Card Offers

Credit card companies rely heavily on credit scores to determine your eligibility and terms. A better score opens the door to premium cards with lower interest rates, more cash back, and travel rewards.

These cards not only save you money but also provide valuable perks.

In contrast, borrowers with low ratings often face high-interest credit cards with limited benefits. They may also have to pay higher fees or security deposits to access credit.

Boosting your score can help you access cards that work in your favor instead of costing you more.

Better Credit Means Cheaper Insurance Rates

Many people don’t realize that insurance companies consider credit a deciding factor when setting premiums. A better credit history often translates to lower rates on auto and home insurance.

Insurers view people with higher credit ratings as less risky, which can save you hundreds, if not thousands of dollars each year.

If your rating improves over time, consider shopping around for new insurance quotes. You may qualify for significant savings with better credit.

How Credit Scores Impact Everyday Living

Your credit affects more than just loans and credit cards—it can impact your daily life in surprising ways.

For example, landlords often check credit when evaluating rental applications. A high score can make it easier to secure a rental and may even lower your security deposit.

Utility companies also use credit scores to determine whether to charge deposits for new accounts. With better credit, you can skip these extra costs and keep more money in your pocket.

How to Stay Consistent When Improving Your Credit

Boosting your credit score isn’t a one-time task. It requires ongoing effort and smart financial habits.

Set reminders to pay bills on time, track your progress using credit monitoring apps, and celebrate small improvements along the way. Consistency is key to building and maintaining a strong credit score.

Suggested reading: How to Manage Money: The Ultimate Guide to Saving

The Long-Term Benefits of a Good Credit Score

A good credit score isn’t just about saving money—it’s about achieving financial freedom. With better credit, you’ll enjoy lower costs, more financial opportunities, and less stress.

You’ll also have more flexibility to pursue your goals, whether that’s buying a home, starting a business, or traveling the world. Improving your credit score also helps you develop better financial habits.

By focusing on paying bills on time, reducing debt, and managing credit responsibly, you’ll create a strong foundation for long-term financial health.

Suggested reading: 15 Must Have Apps to Save Money Going Into 2025

Final Thoughts

Boosting your credit score is one of the smartest financial moves you can make. It’s not just about improving a number—it’s about creating stability, saving money, and unlocking new opportunities.

Whether you’re working to buy a home, pay off debt, or simply reduce monthly expenses, a better credit score can help you get there faster. Start improving your credit today by following the tips in this guide.

Over time, you’ll see the rewards in the form of lower interest rates, reduced debt, and greater financial freedom. The sooner you start, the sooner you’ll enjoy the benefits of a stronger credit score.