Do you want tips on how to manage money to the point where you save more than you are spending? In today's fast-paced, consumer-driven world, saving money might seem like an impossible task. However, with the right strategies and mindset, anyone can become a savvy saver and manage their money better.

Whether you want to become more of a financial planner, a budget-conscious family making every penny count, or a frugal shopper looking to maximize your savings, this guide has something for you to help you save more.

By mastering the art of saving, you not only secure a solid foundation for your future but also pave the way for funding business ventures or generating passive income.

In this post, I will discuss my top 20 favorite ways to save money more and spend less! If your ready, then lets get to it already.

How To Manage Money By Saving More

In order to manage money better, you need to start by saving better. I remember the days when I felt it was impossible to save money with all the expenses that accumulated over time.

However, what it really was is not looking for ways to save on things I used frequently. Because believe it or not, almost any service you use or own has some secret way to save or spend less on it.

One example of a way I started saving was using this Amazon discount link for Prime Video. It gives college students and anyone 18-24 years old six months free with exclusive perks and huge discounts as well.

Here are some of the best ways on how to manage money and save more:

1. Saving Money Like It's Nobody's Business!

Saving money is more than just setting cash aside; it's about creating opportunities. With savings, you gain the freedom to invest in your passions, tackle unexpected expenses without stress, and work towards financial independence.

For families, it's a path to providing stability and security. For entrepreneurs, it’s seed capital for the next groundbreaking idea. By making saving a priority, you empower yourself with choices and the flexibility to seize opportunities as they arise.

Early on in my life, I avoided saving money because there were so many things I wanted. I think they are called “impulse purchases” today HAHA.

Anyway, I always found myself at points of opportunity where I knew I knew if I had money to invest, I could reach success. The thing was, I never had the money because I was always spending it on stuff.

Once I realized how short-lived most of my purchases were, it began to shape my mindset differently in a positive way. I started to see the bigger picture and I wanted more for my financial future.

During this time, I really started to double down and think twice before I bought something. I cannot tell you how many incidents I had where people called me cheap, and to be honest with you, I took it as a compliment!

I knew that I was going to start some sort of business or invest in myself one way or another, and I needed the money to do it. So, in reality it was not me being cheap as much as it was trying to plan more strategically with my finances.

The moral of the story is that every single dollar counts and the more of them you save now, the more it will help you out when the next opportunity presents itself to you.

2. Setting Clear Financial Goals

The first step in any savings plan is defining your financial goals. These goals will guide your saving strategies and keep you motivated. Are you saving for a down payment on a house, a dream vacation, or funding a startup?

Once you know what you're saving for, break down your goals into manageable milestones. This will not only make the process less overwhelming but also allow you to track your progress and celebrate small victories along the way.

I also always try to make my personal financial goals as specific as possible. Start with the basic questions and then take it 3 steps further. How much do I want to save? When do I want to save it by? What expenses can I eliminate to save more?

Find the goal you have for yourself, then ask the question, and lastly create the solution.

3. Creating a Realistic Budget

A well-planned budget is the backbone of any successful savings strategy. Start by assessing your monthly income and expenses. Identify non-essential expenditures that can be trimmed. Allocate a portion of your income specifically for savings.

Budgeting apps like Monarch Money can help automate this process, ensuring you stay on track by using their awesome financial tools. Remember, budgeting isn't about depriving yourself; it's about making informed choices that align with your financial goals.

You also need to make sure it is actually attainable. Sorry, but saying “I want a million dollars by next week”, although it is not impossible, I would not by any means call that attainable.

Start small and work your way up but make sure every stage is attainable for you. This makes it easier to manage and it will be a great confidence booster for you along the way.

I remember how excited it was for me when I used to work hard as a mover 6 days a week and, at the end of every month, I had an extra few hundred dollars in my savings. To be honest, it was almost an addictive feeling, but in a good way.

I enjoyed seeing my savings climb every month and still do to this day. It is definitely a lot more fun to watch it grow than to decline!

4. Cutting Down Unnecessary Expenses

One of the quickest ways to boost your savings is by eliminating unnecessary expenses. Begin by evaluating your spending habits. Do you really need that daily coffee shop visit? And if you are like me, you really like that coffee but you also know it is not worth its value.

Can you cook at home instead of dining out? This is commonly one of the largest expenses anyone has. It is absurd when you think that just one night of eating out is usually worth 2 days of groceries. For just one meal!

Look for areas where small sacrifices can lead to significant savings over time. Implementing these changes can free up funds that are better utilized elsewhere, such as investing or building an emergency fund.

A lot of times, it is easy to instantly think that all expenses are necessary to you. But I assure you, if you think that, you have not looked into your finances well enough yet.

There are always the smallest of expenses that avoid your attention until you see all of them months after the fact, wondering why you did not cancel it a long time ago.

5. mange your money: Practicing Mindful Spending

Adopting a mindful approach to spending can prevent impulse purchases and ensure your money is used wisely. Before making a purchase, ask yourself if it aligns with your financial goals.

Consider implementing the 24-hour rule, where you wait a day before buying non-essential items. This waiting period often reduces the urge to buy on impulse and allows you to evaluate the necessity of the purchase.

6. Using Cashback and Reward Programs

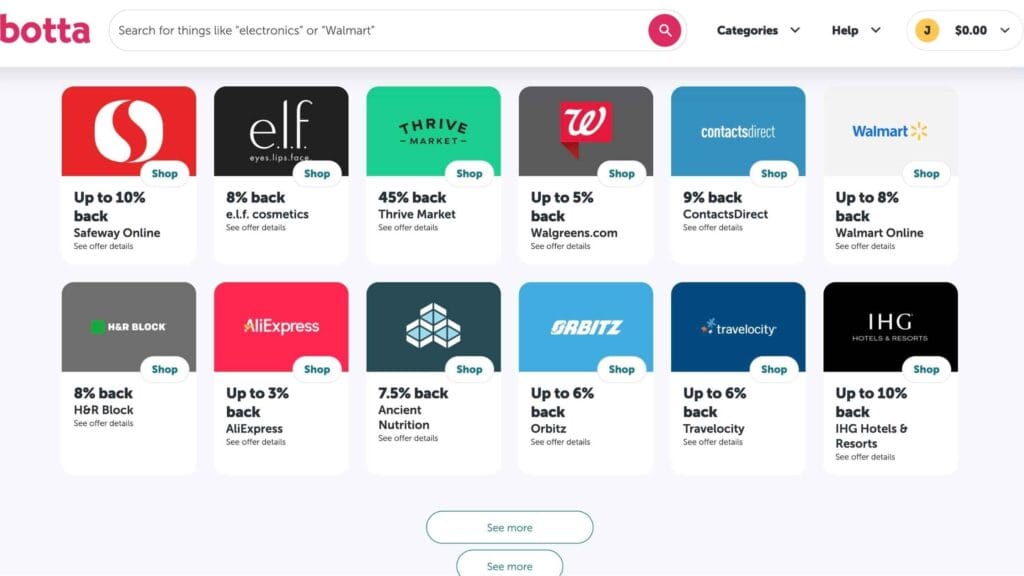

Take advantage of cashback and rewards programs offered by credit cards and retailers. These programs provide an opportunity to earn back a percentage of your spending.

While it's tempting to splurge to earn rewards, maintain focus on your budget and use these programs to enhance your savings, not to justify unnecessary purchases.

Carefully selecting programs that align with your spending habits can maximize your savings potential. Ibotta has some of the best cash-back deals I have seen, which sometimes reach 10 percent and above.

7. Shopping Smart with Coupons and Discounts

Coupons and discounts aren't just for bargain hunters. They are valuable tools for anyone looking to save money.

Search online for digital coupons, sign up for store newsletters to receive exclusive offers, and download apps that aggregate deals from multiple retailers.

With a bit of effort, you can significantly reduce your expenses on everyday items, freeing up more money for your savings goals. Use Ibotta to find awesome savings and discounts on things you use frequently, even services too!

8. Making Use of Loyalty Programs

Loyalty programs reward frequent shoppers with discounts, free products, or other perks.

Many businesses, from grocery stores to airlines, offer these programs. Signing up is usually free, and the benefits can add up over time further improving your skills to manage money.

Ensure you only join programs relevant to your usual spending habits to avoid being tempted into spending more than planned is a great way to how to mange your money.

I know, for example, at my local grocery stores, having a club membership saves me around $1,000 every year! And all I have to do is type in my phone number before I purchase my groceries.

Always ask or check online to see if your favorite stores have these types of membership deals or promotions. It is likely that most of them will.

9. Energy Efficiency at Home

Reducing energy consumption at home not only benefits the environment but also cuts down your utility bills.

Simple actions like switching to LED bulbs, unplugging electronics when not in use, and optimizing heating and cooling systems can lead to substantial savings.

Consider investing in energy-efficient appliances as well; the initial cost may be higher, but the long-term savings make it worthwhile.

If you have read some of my other blog posts, you might have heard me mention how much money I saved by switching from a gas car to a Tesla. I no longer need to pay for car maintenance other than tires, windshield wiper blades, and brakes.

On top of that, charging my car only costs me about $13. I remember this was absurd to me at first because I used to pay $80-$100 for gas powered car.

Many states also offer tax rebates and incentives for people who purchase electric vehicles. I saved $7,500 when I got my Tesla.

If this is something you want to look more into, be sure to use my Tesla promotion code, which will save you hundreds to thousands of dollars!!

10. Preparing Meals at Home

I briefly touched on this earlier in this post. But I will emphasize it again because this is usually peoples largest expense in their bank accounts.

Eating out is convenient but often costly. Preparing meals at home can be a fun and rewarding way to save money. Plan your meals weekly, make a grocery list, and stick to it.

Buying in bulk and utilizing leftovers wisely can further stretch your food budget. Plus, cooking at home allows you to control ingredients and portion sizes, promoting healthier eating habits.

I usually get my food at Costco to buy in bulk because it lasts me longer and saves me way more than my other local stores do. When possible, buying in bulk is usually the best way to go in terms of saving on groceries from my expirience.

11. Utilizing Public Transportation

Owning and maintaining a vehicle is expensive. If possible, consider using public transportation for your daily commute. Public transit can significantly reduce your expenses on fuel, parking, maintenance, and insurance.

Additionally, walking or cycling when feasible can save even more money while improving your fitness and reducing your carbon footprint adding one more way to how to manage your money.

If you work close to home, try using a bike. Not only can it be a fun way to commute but it also gives you a little bump in your weekly exercise.

12. Saving on Entertainment

Entertainment doesn't have to be expensive. Explore free or low-cost activities in your community, such as local festivals, parks, or libraries. Take advantage of streaming services instead of costly cable subscriptions.

Being creative with your entertainment choices can provide the same enjoyment without breaking the bank, allowing you to allocate more funds toward your savings goals.

For young adults between the ages of 18-24, managing finances often means seeking out ways to cut costs while still enjoying the perks of life.

One opportunity is getting Amazon Prime Video for free for six months, especially if you're a college student!

By using this Amazon discount link, students can access a special Amazon Prime Student membership that offers all the benefits of Prime—like free, fast shipping and exclusive discounts—without any upfront cost for six months.

Prime Video includes thousands of movies, TV shows, and exclusive Amazon Originals, allowing you to stream entertainment without adding to your expenses.

If you're in college, this deal becomes even more valuable, as Amazon Prime Student is tailored specifically for students with additional discounts and perks.

Not only do you get the Prime Video library for free during the trial, but you can also access benefits like unlimited photo storage, exclusive student-only offers, and more.

After the six-month free period, you’ll have the option to continue the service at a discounted student rate, which is much lower than the standard Prime membership.

Start saving today by signing up through this Amazon link and enjoy six months of Amazon Prime Video without the added expense.

13. Buying Secondhand

Purchasing secondhand goods is an excellent way to save money on items like clothing, furniture, and electronics. Thrift stores, garage sales, and online marketplaces offer quality products at a fraction of the retail price.

Not only do you save money, but buying secondhand also supports sustainability by reducing waste.

14. Automating Savings

Automating your savings can ensure you consistently set money aside each month. Set up automatic transfers from your checking account to a dedicated savings account.

This method requires minimal effort and helps build savings without the temptation to spend first. Remember, paying yourself first is a powerful step toward reaching your financial goals.

Most banks have this feature if you get automated payments or checks to your account. Go to your banking app and check its settings to see if you can adjust and automate your savings to automatically save money for you.

15. Reviewing and Adjusting Your Budget

Regularly reviewing and adjusting your budget is critical to meeting your financial goals. Life circumstances change, and your budget should reflect that.

Check your progress periodically and adjust where necessary. This practice helps ensure you stay on track and can identify new savings opportunities as they arise.

16. Seeking Professional Advice

Sometimes, professional financial advice is necessary to reach your savings goals. Don’t hesitate to consult with a financial advisor, especially if you're considering investments or starting a business.

I use a lot of the advice today that was given to me years ago by professional consultants and financial advisors because it has stuck with me. It continues to help me and guide me.

How does that saying go? “Give a man a fish, he can eat a meal, but teach him to fish and he can eat for life”. The point is that financial advice from pros is worth it because it can guide you for years and years to come.

In my expirience, most of the information I have been told has held its value and is still consistent even today which, by the way is exactly how you know if it was good or not.

They can provide personalized strategies and insights tailored to your unique financial situation, helping you make informed decisions.

17. Investing for the Future

Once you've built a solid savings foundation, consider investing your money to grow it over time. Look into options like stocks, bonds, or real estate.

The right investment choices can generate passive income, offering financial security and freedom in the future. Be sure to educate yourself or seek advice to minimize risks and maximize returns.

18. Encouraging Family Involvement

Saving money is a team effort, especially for families. Encourage open discussions about finances and involve everyone in budgeting and savings goals.

Teaching children the value of money and savings can instill good financial habits early on, benefiting them throughout their lives.

19. Building an Emergency Fund

An emergency fund is crucial for financial stability. It provides a safety net for unexpected expenses like medical bills, car repairs, or job loss.

Aim to save three to six months' worth of living expenses in a separate, easily accessible account. This peace of mind allows you to focus on long-term goals without worry.

20. Celebrating Milestones

Lastly, celebrate your savings milestones! Acknowledging your achievements keeps motivation high and reinforces positive financial behavior.

Whether it's reaching a specific savings target or consistently sticking to your budget, take the time to recognize your efforts.

These celebrations can also serve as opportunities for reflection and goal-setting for the future.

Last Thoughts On How To Manage Money

Saving money is a vital skill that empowers you to achieve your financial aspirations. By incorporating these top 20 strategies, you'll not only cultivate a habit of saving but also unlock the potential to invest in a brighter future.

Whether it's funding a startup, growing passive income, or ensuring financial security, the benefits of saving are limitless.

Start implementing these tips today, and watch as your financial landscape transforms. For more resources and personalized advice, consider consulting with a financial planner who can guide you on your savings journey.