If you're wondering how to pay off your car faster without overpaying what you can afford every month, this guide is for you. Auto loans are one of the sneakiest budget drains out there. They seem manageable at first, until you realize how much interest you're paying over the years.

The good news is that there are ways to pay off your loans faster, find better financing, and avoid additional expenses. I created this guide because I know what a pain car loans can be when you're trying to manage month-to-month expenses.

Let's take a look at ways you can pay off your car faster and decrease both your debt and you're monthly expenses.

Why Paying Off Your Car Early Is a Total Power Move

Let’s break it down. Car loans typically last between five to seven years. That’s a long time to carry debt on an asset that drops in value the moment you drive it off the lot. Unlike real estate, your car won’t appreciate; it only depreciates.

So not only are you paying out hundreds every month, you're also losing money in value and paying interest on something that won’t hold its worth.

But I also get that car loans are something that are unavoidable for most, including myself HAHA. But what is avoidable is overpaying for your loan, finding the best financing options, and a way to pay your loan off faster.

That’s why learning how to pay off a car faster is such a strategic move. Plus, it’s a huge confidence boost. Paying off your car is like giving yourself a raise, without having to ask your boss.

If you're still in the saving phase, check out our guide on how to save money for a car quickly, which covers smart strategies to lock in the best deal before financing even begins.

Spend Less And Save More

Before I dive into how you can pay off your car faster, I think it is also important to provide you with resources to help you save and manage your money better. This can help you save more money and help you pay off your debts faster.

If you have a high car insurance payment, I highly suggest looking at Lemonade's affordable car insurance options. I just recently switched to their car insurance myself, and it saved me $30 a month! That's literally an extra $360 a year!

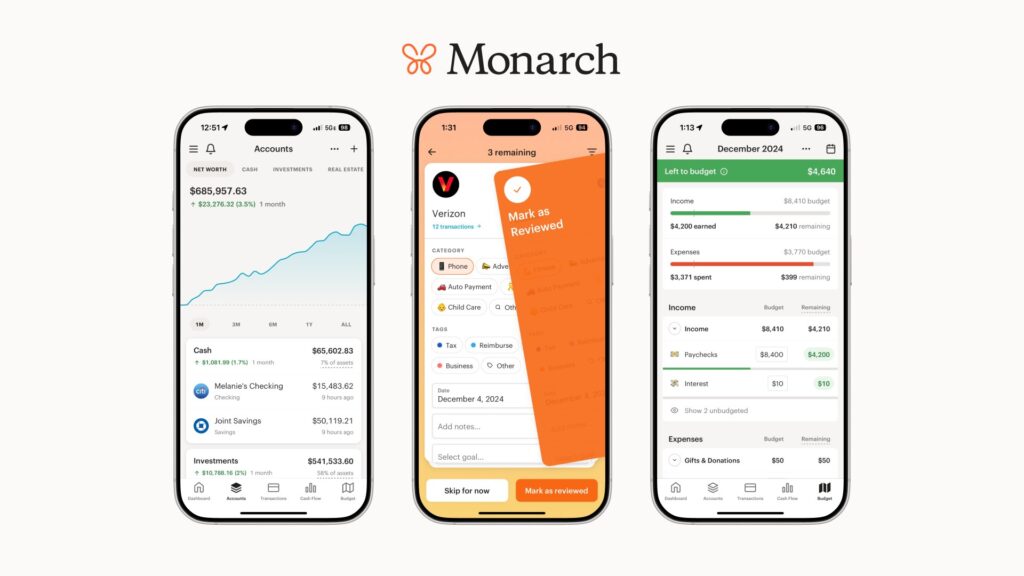

When it comes to managing finances, I like to use Monarch Money. It is by far my favorite financial app to manage my finances. They proide me with all my expenses and earnings all in one place, along with helpful visual graphs and charts.

I have been using Monarch Money for about a year now, and it has been an awesome experience. I truly credit some of my financial improvements in my life to Monarch Money for helping me manage everything in a much easier way.

If you struggle with managing finances and staying on top of things, I suggest using Monarch Money to make managing all things financial much easier!

8 Steps To Payoff Your Car Faster

Here are 8 steps that you can take to pay off your car faster and decrease your debt:

1. Know Your Loan Inside and Out

Before you can come up with a payoff plan, you need to understand your current loan terms. That means knowing your interest rate, remaining balance, and whether your loan includes any prepayment penalties.

Some lenders sneak in fees for early payoff, which could chip away at your savings if you’re not careful. Call your lender or log into your online account to grab a full breakdown of your payoff amount.

Then, use a loan calculator to see how different extra payment amounts would affect your payoff timeline. This is a crucial part of learning how to pay off car faster.

Not paying your payments on time has a negative impact, but nobody has ever said you can't overpay your loan payments. What I mean by this is to think about whether you can afford to put any extra towards your payments each month.

This is one of those long-term mindset strategies. If you pay more now, you will pay less over time, including interest, which is the sneakiest expense of them all.

But the good news is that you can beat interest at its own game by paying it off sooner to avoid more of it.

2. Start Making Biweekly Payments

One of the easiest tricks to pay off your car early without feeling a big financial hit is switching to biweekly payments instead of monthly ones.

Here’s how it works: Instead of paying once a month, split your monthly payment in half and pay that amount every two weeks. Since there are 52 weeks in a year, you end up making 26 half-payments, or 13 full payments per year instead of 12.

That one extra payment may not seem like much, but it can shave several months off your loan and save you a good chunk of interest. And because the payments are smaller and more frequent, it feels way more manageable than dropping big lump sums.

Some people like to think they have more than they really do every month. When you pay bi-weekly, it helps realize a more realistic interpretation of your personal finances.

3. Round Up Every Payment Automatically

Every time you make a payment, round it up to the nearest $10, $50, or even $100 if you can manage. Let’s say your monthly payment is $367.

If you round that up to $400, you’re paying an extra $33 a month, or $396 a year, directly toward your principal. Over time, those small boosts can knock off months from your loan term and significantly reduce your total interest paid.

And because the increases are small, they’re easier to fit into your budget without sacrificing other goals. This is one of the smartest micro habits to master if you're serious about how to pay off your car faster.

4. Use “Extra” Money Like It's Not “Extra”

One thing I have trouble with is using extra money or financial bonuses as an excuse to treat myself to something I don't need. This is something I have recently been trying to work on and improve upon.

Imagine every time you got some extra form of money, you put it towards your loan payment as opposed to one night out of eating dinner. That could have been a whole month's worth of interest right there if used towards your loan.

If you have a tax refund, bonus, or birthday check from grandma, instead of spending it on a weekend getaway or something short-lived, consider throwing it directly at your car loan.

These are a golden opportunity to make big progress in a single move, especially if you’re someone who doesn’t want to commit to extra monthly payments.

You’re using “found money” to pay down debt, and that’s a strategy that’s both effective and painless. It's a awesome way to get ahead and stay motivated.

Want to know how switching vehicles can also save you money long-term? I shared exactly how I saved thousands by going electric in this in-depth Tesla review, and you might be surprised how that kind of move frees up cash for early loan payoff.

5. Cut Just One Monthly Expense and Reallocate It

Here’s where things get creative. Pick one monthly expense you can live without for the next six months. Maybe it’s a streaming subscription, takeout habit, or pricey gym membership.

Then, take that exact amount and throw it at your car loan every month instead. You’ll be shocked at how much faster your balance drops. This approach works because it’s a one-to-one swap.

You’re not asking your budget to do more, you’re just asking it to shift focus for a short burst of time. And when you see how much progress you’re making, you might decide that old expense wasn’t even worth it in the first place.

Run a side hustle or small business? My post on how to create a budget for your business will help you tighten up expenses and redirect extra cash toward faster car payoff.

6. Refinance If It Makes Sense (But Only If)

Refinancing your auto loan can be a smart move if it lowers your interest rate or shortens your term. But here’s the key: only refinance if it aligns with your payoff goal.

Many people refinance to lower their monthly payments and stretch out the term, which actually keeps them in debt longer. That’s the opposite of what we want here.

Instead, look for a refi that offers a better rate and lets you stick to, or shorten, your current payoff timeline. Even knocking your interest down by 1–2% can save you hundreds, or even thousands, depending on your remaining balance.

Just make sure to double-check for hidden fees or new loan origination costs. Refinancing is a tool, not a shortcut. Use it wisely if you're serious about how to pay off car faster.

I would also suggest avoiding the temptation of refinancing to add an extra 2 years to your loan to pay a smaller monthly payment. I get it. It is tempting for everyone, but I urge you not to!

They are meant to be tempting to you because these loan companies would be happy to take more of your money and keep you as a returning customer. But, this is one business you do not want to be a repeat customer for.

If you’re considering refinancing or comparing other loan options, this simple guide to business loans helps you understand loan structures, and what to watch out for in any financing agreement.

7. Use the “Snowball” or “Avalanche” Tactic with a Twist

If your car loan is just one of several debts you’re juggling, you’ve probably heard of the snowball and avalanche methods. But here’s how to give them a twist.

Even if your car loan isn’t your highest interest rate, it may be the most emotionally satisfying to eliminate. The debt snowball method says you should pay off your smallest debts first for quick wins.

The avalanche method says you should pay off the highest interest rates first to save the most money. Both are effective, but if your car loan is weighing heavily on your mindset or monthly cash flow, you can prioritize it for the mental boost.

Once it’s gone, take the money you were putting toward that car loan and roll it into your next debt target. You’ll pick up momentum fast, and that’s the secret weapon of every financial success story.

8. Track Your Progress and Celebrate Mini Milestones

As I mentioned earlier, one of my favorite ways to track progress and manage my finances is using Monarch Money. This could help you manage, track, and improve your finances too!

Motivation fuels consistency, and consistency kills debt. So make it fun. Create a visual chart, a countdown calendar, or a spreadsheet that shows how much you’ve paid and how much is left.

Watching your balance shrink is deeply satisfying and will keep you committed on the days you feel tempted to spend instead of save.

Set mini-milestones, like “$1,000 paid down” or “halfway to debt-free,” and celebrate them in a budget-friendly way. Maybe that’s a home-cooked steak dinner or a personal finance book you’ve been eyeing.

Just don’t sabotage your progress by splurging too hard. Remember, this whole mission is about getting ahead and staying there.

Already crushing other debts too? Read how I tackled student loan debt payoff and reached total debt freedom. It’s packed with motivation and momentum-building strategies that complement your car loan goals.

The Big Win: What Happens After Your Car Is Paid Off

Once you’ve figured out how to pay off car faster and you make that final payment, something magical happens. Your budget suddenly feels light. You’ve got an extra few hundred dollars every month, and now you get to choose what happens next.

Do you invest it or save up for your next car in cash? This is where real wealth-building begins. Because paying off a car early isn’t just about saving money. It’s about reclaiming your income.

It’s about turning your paycheck into a tool for freedom instead of a paycheck-to-paycheck survival cycle. And when you start thinking this way, the whole game changes.

Most Commonly Asked Questions Based on How to Pay Off Car Faster

Can I pay off my car early without penalties?

In most cases, yes, but it depends on your lender. Some loans include prepayment penalties or “interest guarantees,” which charge you for early payoff.

Always check the fine print or call your loan provider to confirm. If there are no penalties, you’re clear to start making extra payments without worry.

Is it better to pay off car loan early or invest?

That depends on your interest rate and your financial goals. If your car loan rate is under 4% and you’re comfortable investing, you might earn more in the market.

But if you value peace of mind and want to eliminate debt quickly, paying off your car offers a guaranteed return by saving you interest and boosting your monthly cash flow.

How can I pay off my car in 1 year?

To pay off your car in 12 months, divide your remaining balance by 12 and aim to make that payment each month. Combine this with biweekly payments, windfalls, and expense cuts. It requires serious focus, but it’s doable with discipline and determination.

Does paying off my car help my credit score?

Paying off your car can have mixed effects on your credit score. It may slightly lower your score temporarily due to a reduced mix of open credit accounts.

But in the long run, it shows strong payment history and reduces your debt-to-income ratio, both of which are great for your credit health.

Should I pay more than my car payment every month?

Absolutely. Paying even a little extra toward your principal each month accelerates your loan payoff and saves on interest.

Just make sure those extra payments are being applied to the principal, not future interest or payments, this sometimes requires manual selection or contacting your lender.

Your Next Move: Own Your Financial Momentum

Now that you know how to pay off your car faster, it’s time to take action. This isn’t just about a car, it’s also about creating financial space, ditching debt, and reclaiming your future.

It’s about saying, “I run this budget, not my bills.” Whether you go biweekly, roll in windfalls, or cut back on one expense, every step gets you closer to a debt-free ride.

So set your target date. Build your plan. Watch the payoff snowball grow. And then? Take that freed-up cash and put it to work building wealth, security, and independence.

Because the faster you finish paying for your past, the faster you can have a better piece of mind knowing your money is going to the things you want it to go to and not the things it “has” to go to.