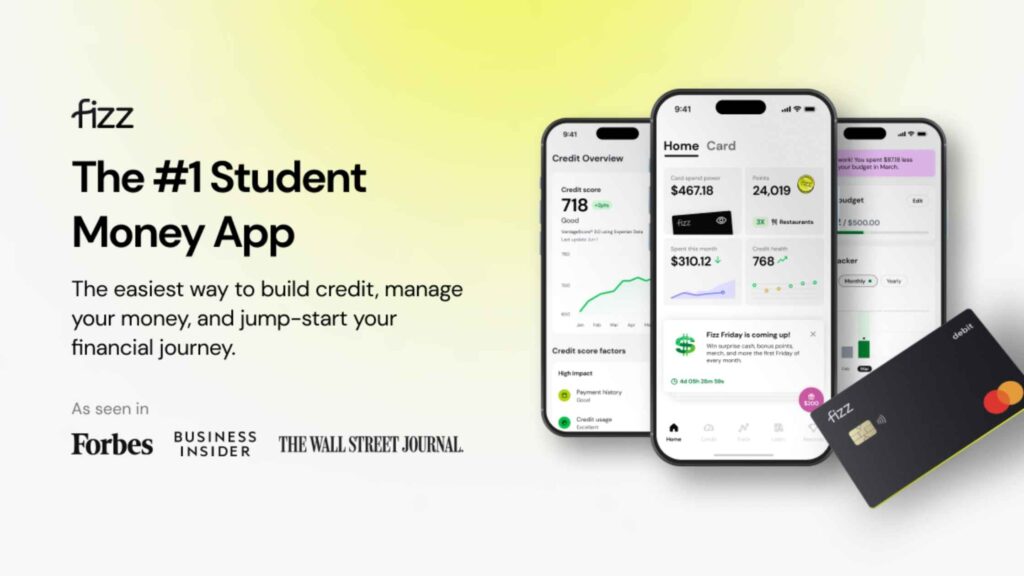

Are you trying to find money management tips for students that actually work and help you manage your finances better? Managing your money as a student can feel like juggling textbooks, takeout, and tuition all at once. But with smart tools like the Fizz app, money management for students becomes a whole lot easier—and even a little fun.

College is often the first time you’re fully responsible for your finances. Between student loans, part-time jobs, and late-night pizza runs, it’s easy for spending to spiral. That’s why building strong financial habits early can set you up for lifelong financial success.

And guess what? You don’t need to be a spreadsheet whiz or have a finance degree to manage your finances correctly. You just need a tool built for your lifestyle.

I created this guide to help students manage their finances better because I once knew what it was like to deal with the stress and overwhelming pressure of financial burdens when you're trying to make it in the world.

If you are a student searching for the answers to help boost your financial understanding and management, this guide is for you! Let's roll:

Why Students Struggle with Budgeting

Let’s face it: budgeting can feel boring or even overwhelming when you’re new to personal finance. You know you should save, avoid credit card debt, and plan for expenses, but it’s not always clear where to begin.

I remember feeling so lost. Questions often popped up in my mind, like what do I start with? How can I save with all these bills? It was just all so overwhelming that I thought it would feel better to just pretend like they were not real questions I had to find the answers to.

Oh, how I WAS WRONG! The truth was, it just hurt my financial life more and more as I avoided these issues. I quickly learned that these questions need answers, and they need them fast!

Traditional budgeting apps can be complex or rigid, and banks aren’t exactly known for being student-friendly. Fizz flips the script. It’s built specifically for students, with features that make tracking your spending intuitive and personalized.

The app connects to your bank account and shows you how you’re spending in real time, offering nudges and insights without the guilt.

There’s no credit card required, no surprise fees, and no confusing elements. It is just clear, actionable advice based on your real behavior. Fizz was specifically built for students so you can rest assured that they understand the learning curve for students.

How To Build Credit Without the Risk

Ahhhh, credit, the thing everyone despises in the finance world, and so many just don't understand. If you do not know what the meaning of credit is, it is basically a grade of how well you know how to manage your finances.

If you have paid off your bills on time and made all your loan payments, your credit will rise over time. However, if you fail to stay on top of your finances, your credit will decline. Either way, credit is a way to measure your performance for best or for worse.

One of the most unique features of the Fizz app is its credit-building system. Unlike traditional credit cards that can trap students in debt, Fizz allows you to build credit responsibly without ever charging interest.

It acts like a debit card that reports to credit bureaus, helping you establish a credit history safely. This is huge because building credit early opens the door to better interest rates, apartment approvals, and even job opportunities in the future.

Plus, Fizz doesn’t rely on a credit check to sign up, which is a relief for students who are just starting out and might not have a financial track record yet. It’s designed to work with you, not against you.

If your goal is to escape the burden of student loans or build long-term income streams, this is your launchpad. For more on that journey, read how to pay off student loan debt and reach debt-free living.

How Fizz Makes Budgeting More Manageable

Budgeting is something most students like to avoid and I would know, because I was once on of them. However, I promise you this is not the answer. Avoiding budgeting will only pull you more into financial hardship, and now is the time to set GOOD HABITS!

The last thing you want is terrible financial habits that translate into your adult life. This will only make things harder for you down the line. Get a head start now and start to gain a better understanding for realistic budgeting.

One of the standout features of Fizz is its real-time budget tracking. You set your spending limits based on your income and expenses, and the app gently keeps you on track.

There’s no penalty or scolding here. It is just smart notifications and encouraging reminders to help you make better choices. Fizz also makes the process of staying on budget fun and exciting.

You earn streaks and rewards for consistent spending habits, which makes managing your money feel less like a chore and more like a challenge you actually want to win.

And let’s be honest here, who doesn’t love a little dopamine hit when you’ve crushed your goals for the week? HAHA. But on a more serious note, Fizz is a great tool for students to help manage their finances and budget effectively.

If you have been searching for money management apps for students, then Fizz is the perfect tool for you to take advantage of.

How Fizz Helps You Spend Smarter

You don’t need anyone to tell you how fast takeout can drain your bank account. I am sure you realize that by now. I get how easy it can be to say “that coffee is only $7” or “that dinner is only $18”. Short term, yes that is true.

However, at the end of the month, do not be surprised when you realize you spent an extra $200 because it all adds up! A lot faster than you probably realize, too.

Fizz helps you visualize these habits. When you see that you’ve dropped $80 on food delivery in a week, it nudges you to reconsider and redirect that cash toward something more meaningful, like saving for spring break or investing in your side hustle.

Fizz categorizes your expenses, so you know exactly where your money goes, whether it's textbooks, transport, or that dangerously addictive coffee habit.

And because it's tailored to student life, the app actually understands your needs instead of assuming you’re a 40-year-old with a mortgage.

spending smarter is very important, but knowing how to manage new income is just as important. Use these 10 smart personal finance strategies for 2025 to build long-term success from your course profits.

Side Hustles, Scholarships, and Smarter Saving

College students are hustlers by nature. Maybe you’re freelancing on Fiverr, running a dropshipping store, or picking up shifts on weekends. Fizz helps you stay organized by tracking all your income streams in one place.

You’ll be able to see your full financial picture and plan smarter for both short-term needs and long-term goals. And if you’re relying on scholarships or student aid, Fizz helps ensure those funds stretch as far as possible.

You can set goals for saving, like putting aside money for study abroad, tech upgrades, or even starting your emergency fund. Small habits today mean serious savings down the road.

Another thing you can do to earn a few extra bucks is download the Freecash App, which helps you earn money with your phone. You won't earn any ridiculous amount, but it's good for earning an extra couple of hundred dollars here and there.

If you’re looking for a flexible, scalable way to make more money while tackling your loans, learn how to create an online course from start to finish and start monetizing what you already know.

FAQ's Based on Money Management for Students

How can students start managing money without getting overwhelmed?

The easiest way to begin is by using a tool designed for your lifestyle. Fizz breaks budgeting into bite-sized, actionable pieces. Instead of overwhelming spreadsheets or confusing categories, it helps you understand your spending as it happens.

Is the Fizz app safe for students with no credit history?

Absolutely. In fact, Fizz is perfect for students who are just beginning their financial journey. It doesn’t require a credit check to get started and uses your bank balance to set safe spending limits.

You’ll build credit without the risk of going into debt, which is a huge advantage over traditional cards. As I mentioned earlier, Fizz is built for students and understands these issues they often face which is why they created a trustworthy tool to help.

Can Fizz actually help me build a credit score as a student?

Yes! Fizz reports your spending behavior to credit bureaus like a credit card would, but without any interest, hidden fees, or the potential to spiral into debt. It’s a way to establish credit while you’re still in school, putting you miles ahead by the time you graduate.

If you’re thinking of using credit to finance tools or software, it’s wise to check out these credit score secrets to skyrocket your score first so you qualify for better rates and rewards.

What makes Fizz different from other student budgeting apps?

Fizz was built for students, not just made to “work” for them. It doesn’t assume you have a steady income or a credit score. It guides your spending in real time, offers personalized insights, and turns building better habits into a game.

The credit-building feature without actual credit risk is also a standout. I personally have not seen a more trusted and legit tool that is specifically designed for helping students.

As your income starts increasing, consider boosting your financial credibility. Here's how to improve your credit score quickly with these ultimate boosters and make your income work double duty.

Wrapping Up Money Management For Students

Money management for students doesn’t have to mean giving up fun, locking your wallet, or worrying 24/7. It’s about being intentional, informed, and in control. Fizz gives you the tools to build better habits, smarter budgets, and a stronger financial future.

With Fizz, you’re not just saving money, but you’re learning how to use it wisely. You’re not just managing a budget. you’re building credit, building confidence, and building momentum toward the life you want.

So, start by download Fizz, connect your bank, and take your first step toward financial independence. Your wallet and your future self will thank you.